Provision no. 341339/2020 issued by the Italian Tax Authority (AGENZIA DELLE ENTRATE) on October 29th, clarifies the means of proof necessary to prove the effective use of the vessel outside the Union territory in order to apply 22% Italian VAT on long and short term contract executed from November 1st and onward.

Read MoreBoth the Italian and Spanish Governments published yesterday, 25th October further restrictions and recommendations due to the increased spread of COVID-19.

In ITALY a new Decree from the President of the Council of Ministers is in place from today 26th October until November 24th containing new actions and prevention measures throughout the national territory. Main points are:

Read MoreThe Italian Tax Authority (AGENZIA DELLE ENTRATE) issued last night Resolution no. 62/E of September 30th 2020 overcoming the previous one (no. 47/E of August 17th see our previous news) pointing out the meaning of a specific verbiage contained in the last paragraph of Resolution no. 47/E (“Alle operazioni…effettuate anteriormente alla data del 1° novembre 2020” - “to the operations executed before November 1st”) that refers to the execution/signature of the charter contract and not to the period of performance of the service, therefore:

Read MoreThe Italian Tax Authority (AGENZIA DELLE ENTRATE) issued Resolution no. 47/E/2020 on August 17th about the postponement to November 1, 2020 of the new VAT Law on charters contained in the Simplification Decree no.76/2020 entered into force on July 17th.

Read MoreThe VAT SMARTBOOK 2020 was printed at the end of June 2020.

On July 17th - unexpectedly and with a huge delay – the Italian Government decided to postpone the entering in force of the new Italian VAT law to November 1st thanks to the “Simplification Decree” N. 76/2020 published on the Official Gazette (Gazzetta Ufficiale, Serie Generale N. 178 del 16/07/2020, Suppl. Ordinario N. 24), entered into force on July 17th 2020 in which the word “April” – contained in subparagraph 726 of Law 27/12/2019 N. 160 – has been replaced by the word “November”).

SOS Yachting France will be the first Tax representative to offer its clients VAT accounting and bookkeeping services for all the transactions carried out in France.

The French Administration has reminded yachts doing commercial activities in French waters that it is mandatory for them to keep the full accounting records of sales and purchases for the period the yachts are in France (including when there’s no commercial activity).

Read MoreIn the Simplification Decree no. 76/2020 published on the Official Gazette (Gazzetta Ufficiale -Serie Generale n.178 del 16-07-2020 - Suppl. Ordinario n. 24), entered in force on July 17th, 2020, the Italian Government introduced a very important modification for VAT on charters in Italy:

Read MoreDue to the COVID-19 health emergency, the SOS Yachting team had to postpone the 2020 edition of the VAT Smartbook from April until July.

We are very pleased to have been able to conclude it and we hope it will help you navigate smoother in the complex “sea” of law and rules that govern the Superyacht charter sector in the EU.

Read MoreDue to the fact the Italian Authorities didn’t released any clarification on paragraph no. 6 concerning the applicability terms of the new law, we have decided to apply a literary interpretation of the wording used in the provision issued on June 15th by the Italian Tax Authority.

Read MoreAfter a long wait, the Italian Tax Authority (AGENZIA DELLE ENTRATE) finally issued yesterday (June 15th) the provision to apply the new VAT Law on charters therefore from now on, regardless the date of signature of the contract, the VAT reduction scheme is no longer applicable and according to the EU Directive, 22% Italian VAT on charters will be due from now on according to the TIME spent in EU waters (therefore does not apply to contracts ended before June 16th).

Read MoreUnder PUBLIC CONSULTATION the draft of the provisions for the application of the new VAT Law on Italian charters.

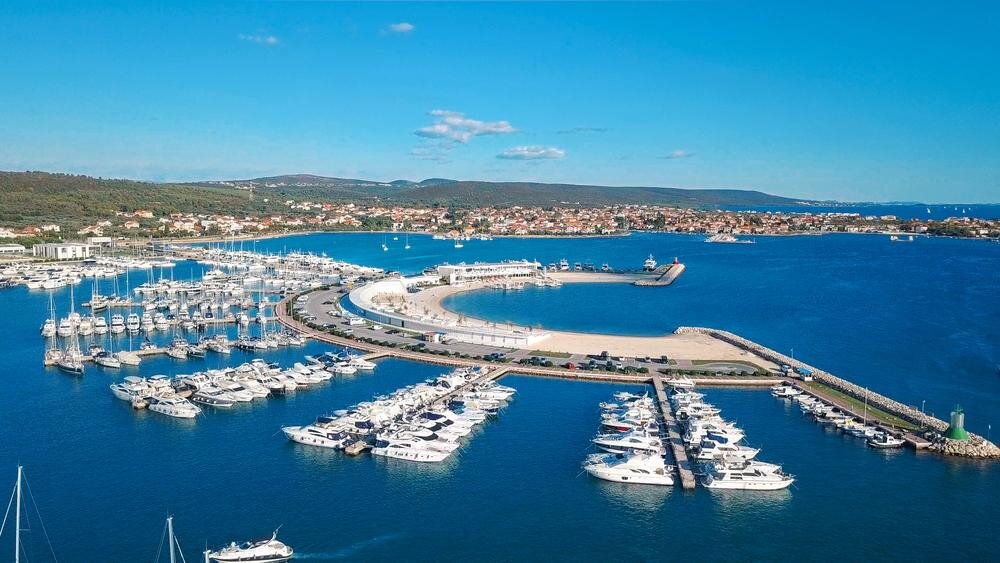

Read MoreThe Croatian Ministry of the Sea, Transport and Infrastructure issued on May 15th 2020 a clarification on cruising and chartering based on the latest Decree published on May 9th, 2020.

Read MoreOn Saturday, May 16 the latest Decree issued by the President of the Council of Ministers was published in the Official Gazette with which it establishes the reopening of almost all production and commercial activities in the Italian territory starting from today, MAY 18, except entertainment companies: cinemas, discos and theaters.

Read MoreSpain has started a plan to go back to the so-called "new normality", consisting in 4 phases, of 2 weeks each, starting from the first week of May. The Spanish Maritime Authority issued on April 30th a clarification regarding charter activity and how it can be carried out.

Read MoreAccording to the Prefectural Decree N° 037/2020 - NAVIGATION OF VESSELS AND MARITIME ACTIVITIES IN FRENCH INLAND WATERS AND TERRITORIAL WATERS IN THE MEDITERRANEAN TO FACE THE 2019 CORONAVIRUS EPIDEMIC (COVID-19) – with some exceptions, all non-essential navigation and maritime activities are suspended until further notice.

Read MoreItaly and France (together with Malta and Cyprus) received in 2018 a letter of infringement by the European Commission on the subject of VAT on yacht rental/chartering based on the crucial point of the effective use of the yacht outside the Union territorial waters for the correct application of VAT

Read MoreOn January 29th, the French Tax Authorities published in the Official Tax Bulletin that the VAT lump sum reduction will be replaced with an effective reduction in proportion of the time spent outside European waters.

Read More